Results Of Black Friday Problems: Crashes & Sales

What would it be like, failing with website performance on the most important day in eCommerce? Wooh. Black Friday website crash left numerous shops out of the track this year. Hope these Black Friday sales results insights would help you prepare for Black Friday 2020.

Black Friday origin & definition

Black Friday is a day (in practice, it is a time range between Thanksgiving and Sunday, continued by Cyber Monday deals), with heavy discounts. It is considered a trampoline for the holiday shopping season.

Surprisingly, the Black Friday meaning was coined by the Philadelphia Police to define that hell of traffic (literal traffic on the roads) caused by hungry shoppers.

First, Black Friday had a tint of negativity in it. The day Black Friday got its name, the Dow Jones Industrial Average fell by 23%, which was the largest drop in stock market history so far. So retailers began their battle of putting a positive layer to the Big Sales day.

What Black Friday means for modern brands and retailers

More sales. Modern retailers and brands have come to realize that Black Friday could be not just a one-day deal. Heavy discounts are applied to start at least a day before and last as long all over through a holiday season with the main sales days being Thanksgiving day, Black Friday, Cyber Monday, Green Monday, and Christmas Saturday.

A possibility to win a competitor’s race at a higher speed. It’s a win or lose game, everything’s just accelerated on a holiday sales rush. This is why this season sellers are especially interested in fast product content delivery to a number of eCommerce websites.

Black Friday summary: Sales & Issues, average order size 2019 vs. 2018, and expectations on 2020

Free shipping saves the game, being the biggest reason shoppers (if hesitating) would make a purchase. The absolute leader in 2018 was Amazon. That year the marketplace made free shipping to non-prime customers (with no minimum purchase). Target and Walmart followed the leader, announcing 2-day free shipping. This year Amazon didn’t follow the same practice, though smart customers found a way. Marketplace gives a 30-days trial for a “Prime” option, which should be more than enough to use all the perks of it during big sales days.

The speed of goods delivery plays a significant role to consumers as well. The dropoff annual holiday survey states that customers drop the cart and do not proceed further with a purchase due to slow delivery. Let’s see what the figures say: 67% of buyers have abandoned presents purchase during the Thanksgiving holidays for that reason; which is a 16% increase from 2017. This year Amazon and Walmart were delivering their own brand goods within 24h.

Interesting fact: 40% of logistics firms are expected to provide a two-hour delivery by 2028 (a study by Zebra Technologies).

2018 was also the first day in Black Friday history exceeding a sales point of $2 billion сoming from smartphones (Adobe Analytics). This year mobile shopping accounted for 61% of sales with $2.9 bn, which is 15.8% YOY increase.

National Retail Federation (NRF) estimates 2018. 165.8 million consumers shopped during the 2018 holiday weekend (between Thanksgiving Day and Cyber Monday). 95% of sales were accounted for gifts and other holiday items. Consumers spent as much as $313 on average.

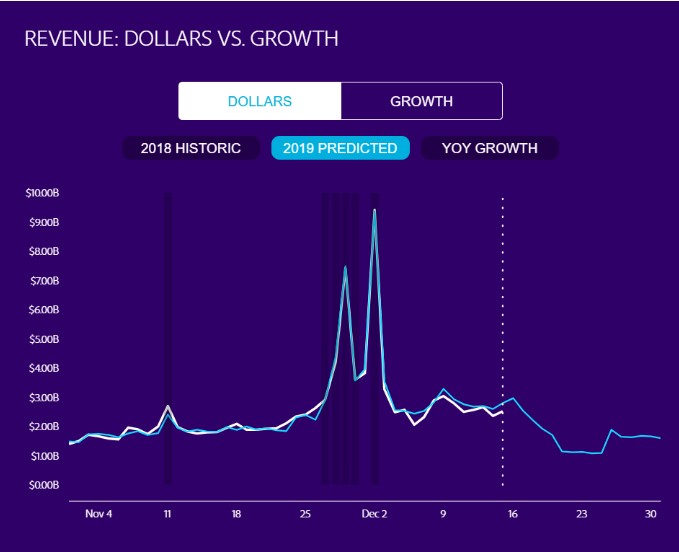

Generally, Black Friday 2018 delivered $6.2 billion in online sales in the US. Compare the results of the previous years in the chart below:

In contrast, let’s have a look at the figures for Black Friday retail results 2019.

What does National Retail Federation (NRF) say? A record 189.6 million U.S. consumers shopped from Thanksgiving Day through Cyber Monday this year, an increase of 14% over last year’s 165.8 million. The average amount spent saw a 16% YOY increase and accounted for $361.90.

Adobe Analytics: Black Friday online sales 2019 cast a record — sellers managed to make $7.4 billion in the US, which is 19.6% YOY growth.

Source: Adobe.com. Read the whole report here.

NRF’s sales figures analysis through the whole “Holidays Season” (with the biggest shopping days being Thanksgiving day, Black Friday, Cyber Monday, Green Monday, and Christmas Saturday) through November 1 – December 31:

What do consumers buy through Black Friday sales 2019?

Apparel (58%), toys (33%), electronics (31%), books/music/movies/video games (28%) and gift cards (27%). Source: nrf.com

Black Friday results are important. Many retailers see Black Friday results as important to their annual performance. For this reason, investors look at Black Friday sales figures as a way to assess the overall state of the entire retail industry. Economists, relying on the Keynesian theory that spending drives economic activity, view high Black Friday figures as a sign of increased growth.

As for Black Friday 2020, it is expected to go even more viral and retailers are to prepare to open a season earlier. Bookmark this page, as we’ll be updating this article with the relevant information on holiday season sales 2020 expectations and useful insights.

Ecommerce vs. brick & mortar stores

Which practice is on top this holiday season sales?

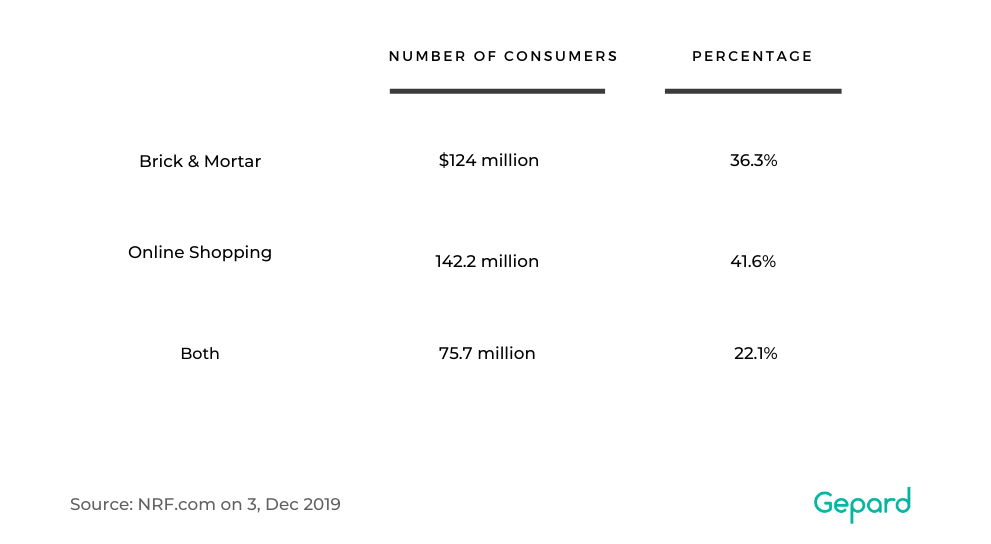

National Retail Federation survey found that 124 million people gave preference to physical stores. Though retailers’ websites exceeded the number with 142.2 million shoppers. There’s still a third option: shop both online and at brick & mortar spots, where we have the figure of 75.7 million. Peculiar thing, consumers spent an average $366.79, which is 25% more than those who shopped in just one: brick & mortar OR online.

Bottom line: consumers seek flexibility. An ability to provide as many shopping options as possible would give brands and retailers a real CA. Black Friday itself brought 84.2 million shoppers to stores and 93.2 million to websites.

Bottom line: consumers seek flexibility. An ability to provide as many shopping options as possible would give brands and retailers a real CA. Black Friday itself brought 84.2 million shoppers to stores and 93.2 million to websites.

What kind of issues retailers and brands was experiencing this Black Friday?

- Website crashes (read more in the next passage).

- Inability to satisfy buyer’s demand. Due to the sales starting earlier, some products were sold out before the sales season ended.

- Facebook Ads Manager errors, resulting in lower returns on ad spend.

Black Friday loss impacted by website crashes

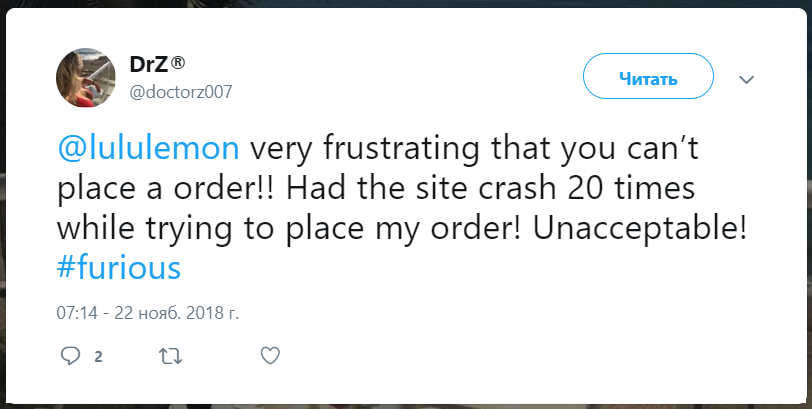

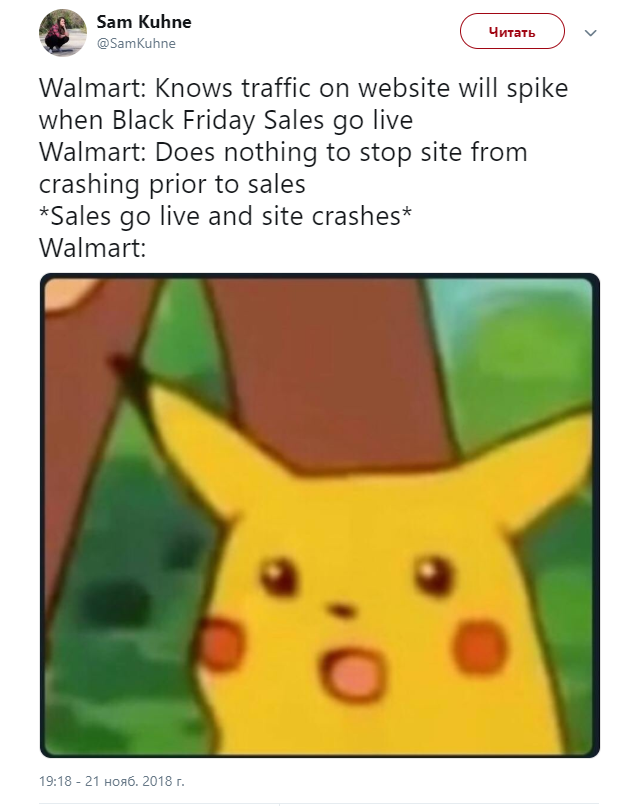

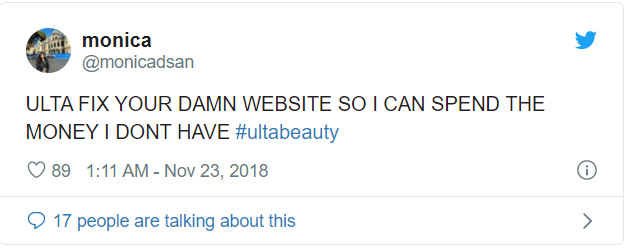

Can‘t everything just go smoothly on the big sales days? Black Friday issues this year manifested in website crashes. Last year loads of retailers, including J.Crew, Lululemon, Walmart, and Ulta experienced issues with their website. The stores did not put sufficient effort into the site’s framework to handle increased online traffic.

In J.Crew’s case, the company lost 323, 000 shoppers which were about to bring $775,000 in about 5 hours.

Walmart might have lost $9 million in just 150 minutes!

Costco said goodbye to $11 million, with a website going down for more than 16h.

What is more, website issues damaged the company’s reputation. Unsatisfied customers flooded social networks with messages of frustration, promising to shop at their competitors instead. And we all know the pace of news going viral on social media. For such a big company, it would be rather easy to earn the money back, which can’t be said about brand image.

Lululemon shop’s customer tweet:

Or can we say that negative PR is still a brand promotion..?

What’s the reason behind websites crashes? Websites were technically not ready to meet increased traffic and lacked a well-performed cloud testing.

How should a company act in such kind of emergency situations?

First, get your employees ready. Let them be prepared to act accordingly. Create an emergency marketing plan. Get a stable eCommerce platform. In the end, the best you can do is to put your efforts into prevention methods.

General recommendations to be taken to get ready for Black Friday 2020

So, how could you win a competitive advantage? We have prepared a Black Friday GET READY list for the brands and retailers that wish to be fully armed for Black Friday 2020.

Retailer’s “TO DO’s” based on consumers’ expectations:

- FREE DROPSHIPPING and SAME-DAY DELIVERY shopping (might be costly, but it is the 1st promotion option one should consider implementing).

- USER-FRIENDLY website/app.

- OPTIMIZE MOBILE EXPERIENCE, it rocks, even more, this year (Digital Commerce 360: Black Friday mobile sales has shown > 46% of revenue, whilst supplying 61% of traffic to retail sites.). Plus: 75% consumers do research or make purchases on mobile devices (which is 9% more compared to previous year).

- BOPIS (Buy-Online-Pick-in-Store). According to Adobe, consumers are 19% more likely to convert when provided with an opportunity to order online and pick the product in-store.

- Be OMNIPRESENT. Here’s why you should go multichannel for Black Friday 2020:

Now it’s hard to distinguish whether shoppers purchase at one or another place, as they might search info on a website with other shoppers’ reviews, scan prices in special apps, do the purchase itself on a retailer’s website or at a marketplace, and pick up an item in-store.

Brands and retailers should put their efforts to be where their customers are. The practice would be smoother when using the right automation tools. Product content push made easier with Gepard Content Syndication.

KEY TAKEAWAYS:

- Black Friday is a massive kickstart and an ability to earn loads of $ and build a company’s reputation.

- Get ready to deal with website crashes, build a safe environment with a reliable ecommerce platform.

- To win the game — go omnichannel, be flexible.