Home Improvement Retail Industry. eCommerce Guide For Brands

Not a long time ago the home improvement DIY market was just a brick-n-mortar business. Home improvement store industry giants like Home Depot, Lowe’s, BAUHAUS, and Leroy Merlin, didn’t leave any chances for small and medium retailers to compete. It is a different story now. Home improvement and DIY (do-it-yourself) market began to grow, bringing in more different-size brands and retailers.

Read about home improvement industry trends, how the top market players conquer eCommerce sales platforms, what data challenges they face, and how product information management systems can solve the data-related issues for home improvement retail.

What Is The Home Improvement DIY Market?

Home Improvement DIY Industry Examples

To get a better comprehension of the home improvement industry,, we will break down home improvement products examples. We could divide home improvement goods into four categories based on the price level and usage.

- Basic home necessities (light bulbs, lamps, screwdrivers, door/window handles) up to $25

- Simple hardware, tools, and accessories (screwdriver sets, different types of filters, fire detectors, shower/kitchen hardware parts ) $25-$50

- Simple power tools and accessories (power drills, fans, kitchen/bathroom faucets, sinks) $50-$100

- Mid-price tools and fixtures (kitchen sinks, lighting fixtures) $100-250

- High-price tools and fixtures (doors, bathtubs, multi-power tool kits, table saws) $250+

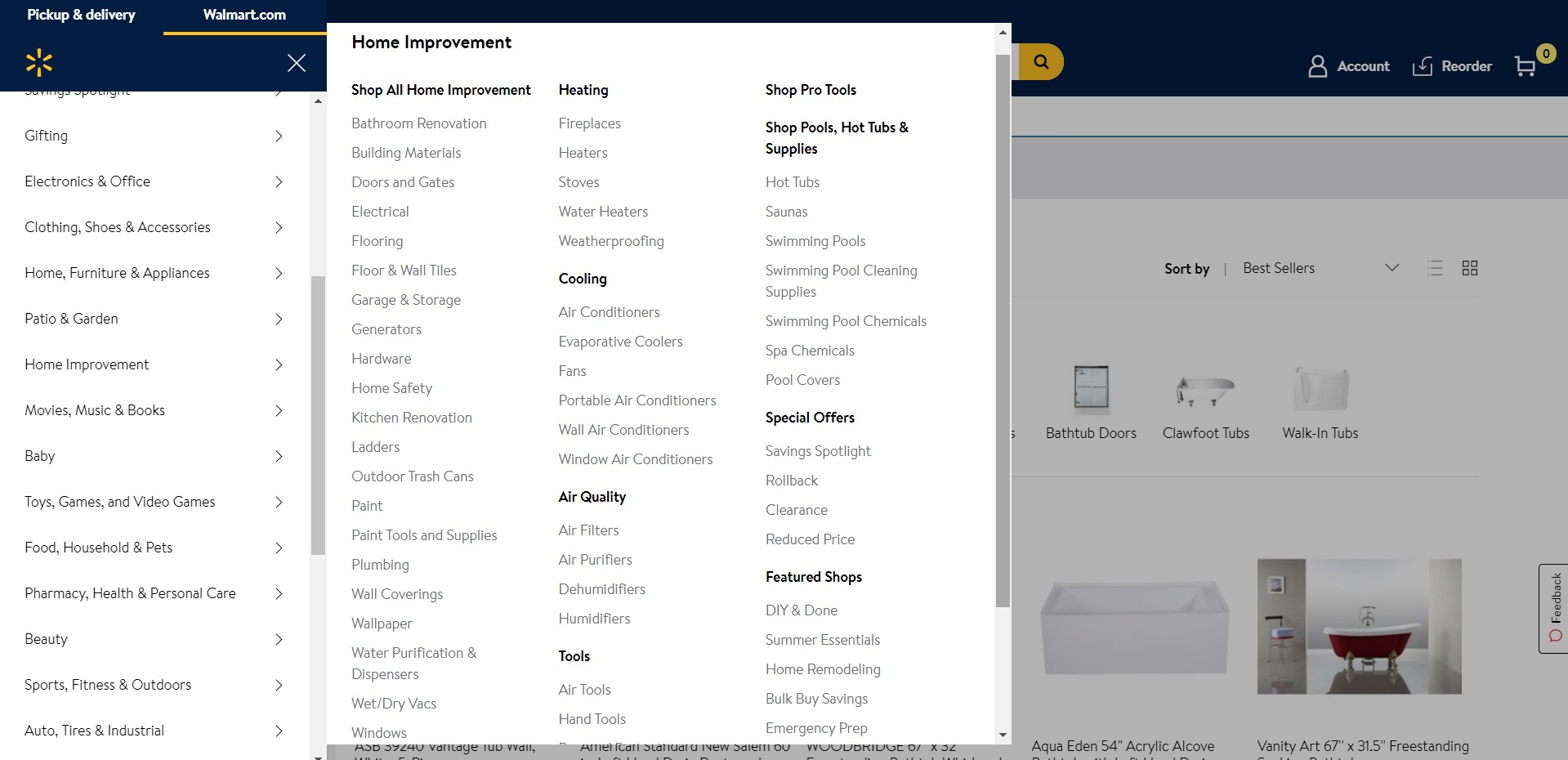

In Walmart home improvement catalog, for example, home improvements are presented in these categories: Heating, Cooling, Air Quality, Tools, Pools, Hot Tubs & Sone of the top 5 home improvement stores, presents the next categories in its home improvement & DIY catalog: Heating, Cooling, Air Quality, Tools, Pools, Hot Tubs & Supplies, DIY & Home, etc.

Fresh Statistics on Home Improvement DIY Market

The home improvement retail industry is ever-changing, so here are some of the recent researches and statistics on the industry.

- Home improvement searches doubled over the last year. Since the start of the Covid pandemic, people have started to search more for home improvement products. The search increased twice from 2020 to 2021. Also in 2021 people were looking for home appliances 26% more often than in last year.

- Home improvement retail stores revenue increased by 8.5% (according to IHS Markit). Most of the purchases happened after online research, which proves the importance of product information management for sales improvement.

- 76% of property owners are not going to travel in 2021 (according to the U.S Census Bureau). It means that people will use this time for home renovation and home improvement retailing will keep growing. It’s high time for the industry businesses to offer an excellent buying experience, build brand awareness, loyalty, and improve their reputation.

- 40% of buyers have a new hobby related to DIY home improvement. Consumers state that during the lockdown they found a new pastime, and usually it presumed home improvement. This trend, caused by a pandemic, is still topical and will, most likely, create opportunities for industry growth.

Home Improvement eCommerce Trends

1. The importance of user-generated content constantly grows

Having quality user-generated content (e.g. product reviews, unboxing videos, images, and other content, created by individual buyers) makes a difference for the home improvement retail industry. It significantly increases the chances of purchase, builds customer’s trust and brand loyalty. Many potential buyers say that they need more educational materials about home improvement products, such as tutorials, expert help, or practical reviews.

It demonstrates that home improvement eCommerce stores should not underestimate the importance of user-generated content for their business, and include it in their content marketing strategy.

2. Moving towards sustainability

Sustainability and eco-friendliness are becoming important home improvement industry trends. Consumers become more conscious about shopping, which means that they tend to choose eco-friendly ethically sourced DIY home improvement products. Brands and manufacturers that take action to help nature and make a positive social impact, are also in favor.

There appear to be more quality regulations for eCommerce businesses. The new databases, such as EPREL (European Product Database for Energy Labelling), allow retailers to check if their suppliers are eco-friendly and keep up with the high quality.

Gepard works with EPREL standards and makes it easy for manufacturers to follow the high retail standards and satisfy customer’s need for sustainable DIY home improvement shopping.

3. “Work from home” impact

Remote work, caused by COVID lockdown, turned people’s houses into home offices, which keeps influencing the home improvement retail sales. Consumers shop for home improvement products that not only add up to their comfort but also increase their work productivity. The idea of home design is changing and customers tend to purchase home improvement products they’d never consider buying while working from the office. As more and more companies choose to work remotely, most probably the “home office” will stay among the most decisive home improvement industry trends.

4. Repurpose of existing spaces

Searching for rooms’ new multiple functions is one of the latest home improvement market trends. Multi-purpose and remodeled spaces are becoming more popular, as well as using the repurposed items rather than buying new ones. This trend should make the home improvement industry players think of offering products that add home value and, as already mentioned, satisfy the customer’s need for sustainable consumption.

Top 5 Home Improvement Stores

Even though the small home improvement businesses are drastically growing, consumers keep shopping in leading home industry market players.

Home Depot together with Lowe’s Companies has about 30% of the US market share in the home improvement retail industry. Apart from offering both online and brick-and-mortar shopping experiences, the next-day delivery, bulk right-off-the-shelf shopping, and excellent in-store help, one of the distinctive features of Home Depot is so-called product authority, which means the retailer tries to offer the best blend of exclusionary brands and innovative products, catering both DIY buyers and professional customers. Their interconnected retail strategy lets them sell omnichannel and increase sales.

Lowe’s, the second home improvement industry leader in the US, beat the smaller competitors with its “total home” business strategy, which means that the retailer offers “total home” improvement solutions for clients, whereas each area of home could be improved with the help of Lowe’s products and services.

The retailer started to focus more on pro customers who bring the biggest revenue to the company, and also updated their installation services – the strategy that could be used by smaller competitors to expand the market by offering a wholesome customer experience.

The leading home improvement retail in France (with 36% market share) and one of the top European home industry players, Leroy Merlin wins with its smart home technologies and sustainable solutions. Its eco-options enable the customers to have a healthy ecological home, using renewable energies and respecting the environment. Considering the worldwide movement towards eco-friendliness, supporting sustainable consumption is a win for Leroy Merlin, and also a strategy to follow for its smaller competitors.

Amazon, the leading retail platform, introduced the Tools & Home Improvement Category, which immediately started to compete with the biggest home industry players. Amazon took advantage of the world’s digitalization and focused on Home Automation products (e.g. Alexa voice-activated personal assistant). The home automation category became a magnet for buyers, looking for smart house solutions. Amazon’s Smart Home Industry and “The Internet of things” is a great example for industry retailers how keeping up with the world’s digital trends can pay off.

IKEA, mostly popular in Europe (73% market share), is steadily expanding in Asia as well. The leading home industry retailer is a great example of how authentic marketing can increase sales. IKEA invests a lot in influencers marketing, which provides the company with a large amount of effective customer-generated content. Another IKEA successful strategy, that can be used by smaller retailers, is co-creation: the retailer involves not only the key stakeholders in creating products together, but also encourages the customers to take part in designing their ideal home through special programs and social media publications.

Home Improvement eCommerce: Challenges with Product Data

Product information management is as crucial for home improvement retailers as for any other eCommerce business, as the industry leaders face many data-related issues.

The big scope of product information & data collection challenges

Large amounts of data from suppliers can be in different formats and not adjusted to the retailer’s taxonomy, which makes it difficult to work with data. It limits the opportunities for both retailers and brands: the first ones cannot engage more manufacturers and the latter cannot expand to more sales platforms.

Poor data quality & limited options for data enrichment

Product content, received from manufacturers and brands quite often is not verified, has a lot of data errors, frequently is outdated, which requires a lot of further data improvement. It forces the retailers to either stop onboarding such brands on their sales platforms, or to invest a lot of time and money into content enrichment.

Slow time to market

Poor data quality results in slow product launches. Instead of selling the product, the home improvement retailing businesses spend time on product content improvement. Meanwhile, their competitors already benefit from compelling product content and fast time-to-market.

Lots of monotonous work & staff burnout

Continuous manual work with data leads to personnel’s burnouts and lack of productivity. The employees keep managing data spreadsheets and manually enriching the data, instead of focusing on more worthwhile business tasks and strategies.

How to Solve Data Challenges With Product Information Management?

Data automation, brought in by the Gepard PIM system, effectively solves home improvement industry data issues.

- The PIM system serves as a single source of truth. All the product information is saved in one place, easily accessible by all team members, which improves the company’s workflow.

- A multifunctional set of instruments enables you to enrich the received content, create unique captivating product descriptions and motivate consumers to make a purchase.

- PIM’s data collection & validation tools automate the data gathering process, verify the data and keep it constantly updated, which increases the company’s reputation and customers loyalty.

- Intelligent mapping techniques allow easy data synchronization and standardization. The companies can be confident about product content, as it follows the latest regulations, while standardized product data lets you expand your business internationally and get more customers.

- Automated data collection and transformation reduce the amount of manual work, minimize the chances of human error, and prevent staff burnout.

Gepard: Walk Hand-in-Hand with Industry Trends

With Gepard’s full functionality and easy-to-navigate interface, you can guarantee your clients an unforgettable customer experience, boost your sales and make sure your staff is focusing on tasks that bring value to your business.

Keep up with the latest industry trends – book your Free Personalized Demo now.